Here’s how much more the borrower with excellent credit ended up saving: Take a 30-year FRM, in Connecticut, with a loan amount of $100,000 FICO Score:Ī borrower with average credit (620-639) ends up paying $536 per month on a 4.9% APR, for a total $93,124 interest paid.Ĭompare that to the person with excellent credit (760-850), who obtains a 3.4% APR, $445 monthly payment and $60,033 total interest paid. Take a 30-year FRM, in Connecticut, with a loan amount of $100,000: How Much Mortgage Does your Credit Score Buy You?īy far, your credit score can make or break the type of mortgage loan you’ll be able to get when buying a home, since the interest rate you qualify for informs how much your monthly payment will be.Ĭonsider how much you’re likely to save according to your credit score. In time, you'll qualify for more lucrative credit card offers.Ĭonsumers with excellent credit are more likely to get approved for premium rewards credit cards with extravagant travel credit cards or powerful cash back programs. Look, they may not have flashy rewards or perks, but they set the stage for credit score improvement. There are credit cards designed for people with average credit. What about some cards for credit scores that aren’t bad or excellent, but fair to good? When it comes to credit cards, you may better qualify for a certain card depending on your score.įor instance, if you have bad or no credit, a secured credit card is an ideal “starter” card. Naturally, the higher the credit score, the better types of lending products and interest rates you’ll be able to land. Is it an indicator that Americans are getting better with their credit habits? How Much Credit Card Does Your Credit Score Give You? In April 2005, 20.4% of consumers held a 750-799 credit score range. The higher echelons of the scale - 750-799 and 800-850 - have increased just slightly over the years, according to. This number has steadily climbed since October 2005, when the average score was 688. The average credit score in the United States is 706, according to - which puts it in the “Good” credit range.

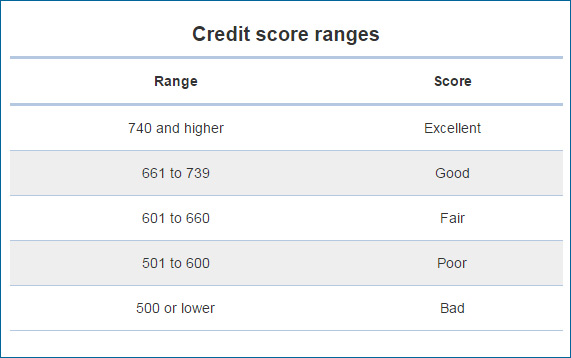

Scores are broken down into a few categories, from poor to excellent:

:max_bytes(150000):strip_icc()/dotdash_Final_What_Credit_Score_Should_You_Have_May_2020-01-835d268d06fb4abd9a63033d40b5e9f7.jpg)

Your FICO scores incorporate all your positive and negative borrowing/lending activity, and breaks it down according to a few factors:Īll of this activity is reported to the three credit bureaus - Experian, TransUnion and Equifax - which is then listed on your credit report and, in turn, comprises the bulk of your credit score. But how are these scores determined, and what exactly makes a good (or even great) credit score range? financial institutions use FICO credit scores. The most common used credit score is the FICO (Fair Isaac Corporation) Score, which has a range of 300 to 850.Īccording to FICO, 90 of the top 100 U.S. how likely you are to pay money back that you’ve borrowed. Your credit score is the numerical measure of your consumer credit health, the number that lenders look at when determining how creditworthy you are, i.e. The state of your credit is one of the most important factors when it comes to qualifying for and securing a low interest rate on an auto loan, a rewards credit card, or a mortgage, for example. Having good credit is the essential foundation to a healthy financial life.

#US CREDIT SCORE RANGE HOW TO#

Comprehensive Coverage Options Ways to Lock in Lower Homeowners Insurance Premiums How to Choose the Right Life Insurance Policy Compare the Different Types of Health Insurance Plans Popular Reviews Progressive GEICO State Farm AIG Allstate Banking Best Products Best Savings Accounts Best Checking Accounts Best CD Rates Best Money Market Accounts Best Business Checking Accounts Best Student Checking Accounts Calculate Checking Accounts 101 Emergency Savings Calculator Compare CD Rates Checking Accounts Personal Loans Best Products Best Personal Loans Best Debt Consolidation Loans Best Home Improvement Loans Best Medical Expenses Loans Calculators & Guides Personal Loans Calculator Guide to Personal Loans Guide to Refinancing Student Loans How to Consolidate Credit Card Debt Popular Reviews Upstart Payoff Sofi Lending Club Investing Best Products Where to Invest Money Best Brokerages Best Robo Advisors Read & Learn Investing 101 How to Buy First Stock How to Invest in Mutual Funds How to Pick a Financial Advisor How Much to Save for Retirement Popular Reviews Betterment Merill Edge Wealthfront Insurance Best Products Best Auto Insurance Best Home Insurance Best Life Insurance Best Health Insurance Read & Learn Figure Out How Much Auto Coverage You Need Collision vs.

0 kommentar(er)

0 kommentar(er)